Bitcoin at parity with Gold

Bitcoin at parity with Gold

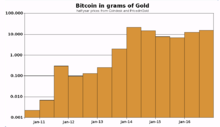

Yesterday evening at 1700 GMT the value of bitcoin surpassed the value of gold, this is the first time any currency has reached that level, could this mean raise the possibility of a change to a new standard.

Below is an extract from wikipedia

Gold standard and Bitcoin

Bitcoin in grams of goldAccording to research produced by the Bank of Canada, the emerging Bitcoin economy has many similarities with the economy based on gold standard, in particular:[86][87]

-

limited and predictable supply of the anchor of the monetary system

-

no central bank or monetary authority controls the supply

-

low or non-existent inflation

-

virtually no arbitrage costs for international transactions

-

Governments have less control over their domestic economies

-

Governments lose seigniorage revenues that they obtain from the ability to almost costlessly create money

Edward Hadas and Michael Hiltzik noted that monetary systems based on Bitcoin and gold have some similar disadvantages:

George Gilder, a proponent of gold standard, proposed breaking "the government monopoly on money" by using a combination of Bitcoin for the internet and treating gold in tax terms as currency.[90][91]

How Will Governments React ?

Bitcoin and other cryptocurrencies are a thorn in the side for conventional Fiat currency which have all abandoned the gold standard of the past when they started to print money as and when they needed. In time of Crisis many people move investments into gold as a safe haven, however holding gold presents a problem its heavy and incurs storage costs and not convenient for day to day shopping. In early times it was not unusual to chip bits off a coin to make payments.

cryptocurrencies can be used both for shopping and person to person transactions protected by blockchain’s. They can easily be moved across borders, even though some countries and the EU are looking at ways of restricting this. It is only when you exchange fiat currencies to and from cryptocurrency that governments may be able to glean information from exchanges. It might make sense for forward looking governments to accept cryptocurrency payments/

Banking is already starting to suffer because the cost of moving money from one country to another via cryptocurrency is minimal compared to fees charged by banks. Also ordinary people are now moving savings into cryptocurrencies which are building a history of yearly growth higher than saving rates.

The use of bitcoin as forex instrument has been explored by banks in the past. A notable example is that of Shinhan Bank, a major South Korean financial institution that began a remittance service in the Korea – China corridor, with bitcoin. Faster, near-instant settlements at significantly lower costs are some of the straightforward benefits of using bitcoin in remittance.

David Ogden

Entrepeneur

David Http://markethive.com/david-ogden